Life Insurance in and around Shreveport

Get insured for what matters to you

Life happens. Don't wait.

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

There's a common misconception that young people don't need Life insurance, but even if you are young and just rented your first place, now could be the right time to start learning about Life insurance.

Get insured for what matters to you

Life happens. Don't wait.

Wondering If You're Too Young For Life Insurance?

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With a protection plan from State Farm, you can lock in outstanding costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Neil Shipp or one of their resourceful team members. Neil Shipp can help design an insurance policy personalized for coverage you have in mind.

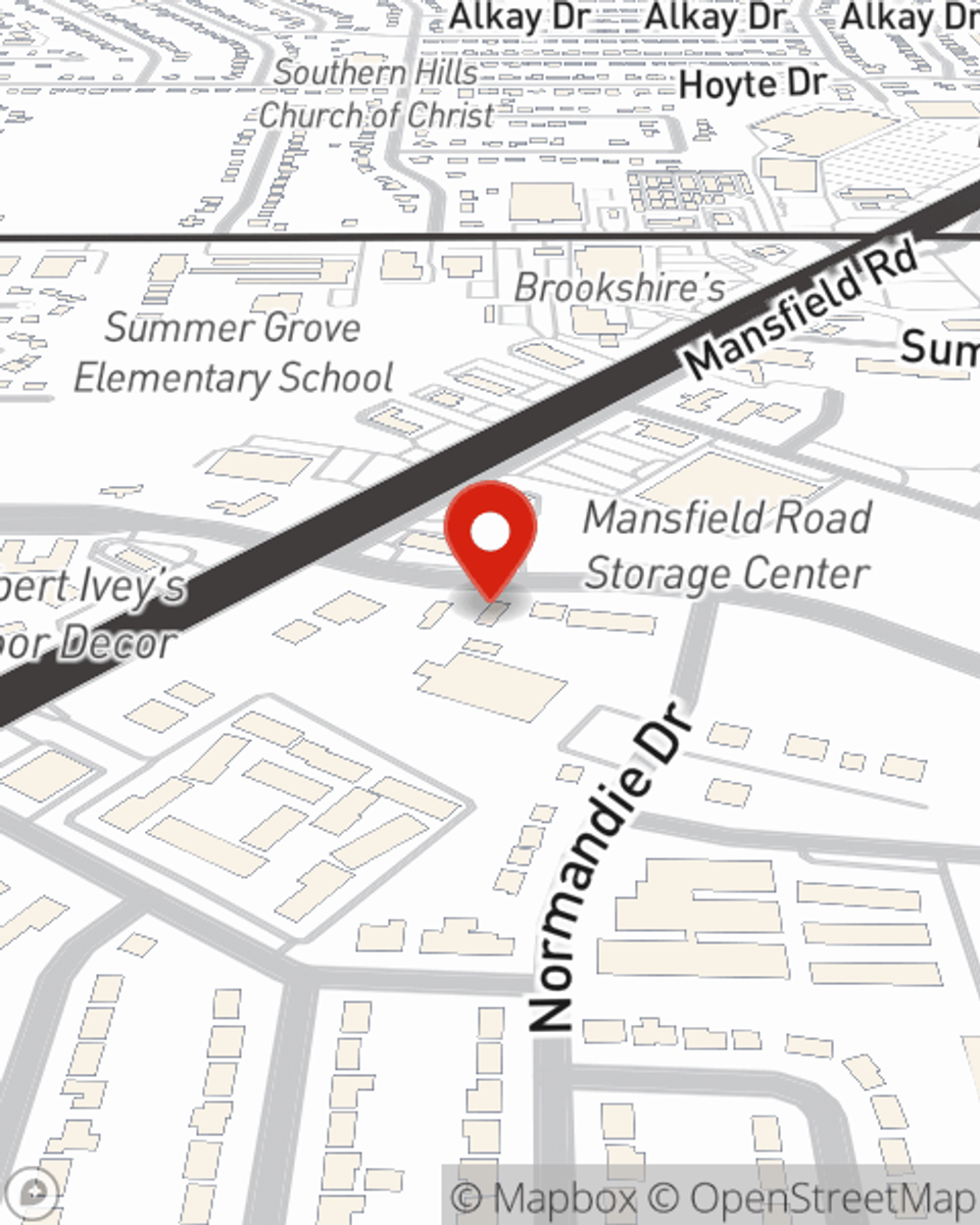

As a leading provider of life insurance in Shreveport, LA, State Farm is ready to be there for you and your loved ones. Call State Farm agent Neil Shipp today for help with all your life insurance needs.

Have More Questions About Life Insurance?

Call Neil at (318) 688-1522 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

Simple Insights®

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.